9 financial tips you must know during the 9 months pregnancy

Congratulations on the expansion of your family!

After the initial excitement, most of you will start to have a panic attack because the responsibilities on your shoulder have just gotten heavier. Taking care of another family member is going to put a dent on your finances but don't get so stressed that you start taking on a part-time job or borrow money. You have 9 months to prepare and manage your financial health before you welcome this bundle of joy!

Here are 9 tips on how I managed my finances, which I think could help all new parents embark on a financially-sound future:

1) Compare prices of gynaecologists

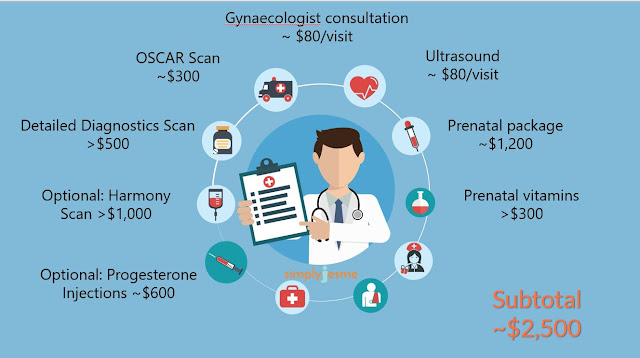

The costs of a gynaecologist vary widely between a government hospital and private clinics. The more popular ones usually require at least an hour of waiting in line so be prepared for that. Some indicative prices are stated here:

Do take note that in some cases such as premature babies or jaundice treatment, your baby might need to stay in the hospital for a longer period of time. For a neonatal intensive care unit (NICU), the daily ward charges would be up to $647 in NUH (for A1 ward type), or more at a private hospital, so be sure to have some emergency funds on hand.

Bonus: The location of the gynaecologist's clinic is also important because you would want a convenient place to go for a check-up every month.

2) Compare the cost between different hospitals

For private clinics, you can only choose the private hospitals for delivery such as those listed below. They will cost higher than public hospitals. You can check the average hospital delivery charges based on ward, normal vaginal birth and caesarean section from the MOH website. Take note that the price listed is after the deduction of Medisave claimables. Based on my delivery in 2016, my bill works out to be $7,040.

Bonus: Find out which credit cards will give you the most rewards/cash rebates for these hospital charges.

3) Buy online and look for deals

There are many baby items to buy and one way to save cost and effort on transport is to buy online. You can also visit baby exhibitions to take advantage of special offers. Before the arrival of the baby, you will need to plan and purchase these 20 things, such as baby cot, diapers, wet wipes and sterilizer. I spent less than $1200 for these things and these expenses can be made over a few months. You don't have to buy everything at one go.

Bonus: Hospitals do give free gifts to new parents such as bath tub, nursing covers and diaper bags. So do some research on what you will be getting and only buy what is needed.

4) Know your benefits

When my foreign friends heard of our government grants for maternity, the first thing they said was, "So good, how envious!" Not every country has such incentives to support parents, so let's take a look at the benefits that are available.

👶The Medisave Maternity Package allows parents to use their Medisave to claim for pre-delivery expenses, such as pre-natal consultations, ultrasound scans. It can also be used for delivery expenses up to the Withdrawal Limits.

In summary, here are the Medisave withdrawal limits to take note of and total cash and grants you may be eligible for:

Bonus: On top of these grants, parents will also qualify for tax relief.

Now that you know the costs involved, you should start setting aside a small amount of savings each month in preparation for the baby's expenses. If you still have existing debts, furniture loans, wedding loans, renovation loans, it would be wise to clear them before the arrival of the baby. This will help to prevent you from getting overburdened when additional recurring costs come in.

It's a good time to tidy up your house and arrange a space for baby stuff. Some unnecessary cost includes buying too many baby clothes, feeding sets, shoes and toys. These are things you will receive as gifts from family, friends and relatives and so, there is no hurry to buy them first.

A confinement nanny is helpful to parents during the first month. Do reserve them as soon as possible as the popular ones are snapped up very quickly. Be aware that price is around $2,500 to $3,000, excluding cooking ingredients. If you are without a confinement nanny, you may intend to get confinement meals which cost around $60 a day for both lunch and dinner. For post-natal massage, 5 sessions cost around $300.

After the initial excitement, most of you will start to have a panic attack because the responsibilities on your shoulder have just gotten heavier. Taking care of another family member is going to put a dent on your finances but don't get so stressed that you start taking on a part-time job or borrow money. You have 9 months to prepare and manage your financial health before you welcome this bundle of joy!

Here are 9 tips on how I managed my finances, which I think could help all new parents embark on a financially-sound future:

|

| Not just love, you need financial planning too! |

1) Compare prices of gynaecologists

The costs of a gynaecologist vary widely between a government hospital and private clinics. The more popular ones usually require at least an hour of waiting in line so be prepared for that. Some indicative prices are stated here:

|

| Breakdown for my approximate pre-natal charges in private clinics |

Bonus: The location of the gynaecologist's clinic is also important because you would want a convenient place to go for a check-up every month.

2) Compare the cost between different hospitals

For private clinics, you can only choose the private hospitals for delivery such as those listed below. They will cost higher than public hospitals. You can check the average hospital delivery charges based on ward, normal vaginal birth and caesarean section from the MOH website. Take note that the price listed is after the deduction of Medisave claimables. Based on my delivery in 2016, my bill works out to be $7,040.

|

| Average hospital charges by ward and hospitals, accurate as of 3 May 2017 . Source: MOH website |

Bonus: Find out which credit cards will give you the most rewards/cash rebates for these hospital charges.

3) Buy online and look for deals

There are many baby items to buy and one way to save cost and effort on transport is to buy online. You can also visit baby exhibitions to take advantage of special offers. Before the arrival of the baby, you will need to plan and purchase these 20 things, such as baby cot, diapers, wet wipes and sterilizer. I spent less than $1200 for these things and these expenses can be made over a few months. You don't have to buy everything at one go.

|

| Pay by credit cards and get some rewards back |

4) Know your benefits

When my foreign friends heard of our government grants for maternity, the first thing they said was, "So good, how envious!" Not every country has such incentives to support parents, so let's take a look at the benefits that are available.

👶The Medisave Maternity Package allows parents to use their Medisave to claim for pre-delivery expenses, such as pre-natal consultations, ultrasound scans. It can also be used for delivery expenses up to the Withdrawal Limits.

In summary, here are the Medisave withdrawal limits to take note of and total cash and grants you may be eligible for:

|

| Maternity package and withdrawal limits |

👶There is also a Medisave Grant for Newborns. The amount goes into your child's Medisave account that will help with the costs of his/her recommended childhood vaccinations, hospitalisation and approved outpatient treatments. It can also be used to pay for your child's MediShield Life premiums.

In addition, there is the Baby Bonus Scheme, which includes a Cash Gift and Child Development Account (CDA) benefits.

|

|

| *Applicable for 1st and 2nd child. Refer to Baby Bonus Website for 3rd and subsequent birth orders. Total cash and grants from the government. |

Bonus: On top of these grants, parents will also qualify for tax relief.

5) Start a baby fund

Now that you know the costs involved, you should start setting aside a small amount of savings each month in preparation for the baby's expenses. If you still have existing debts, furniture loans, wedding loans, renovation loans, it would be wise to clear them before the arrival of the baby. This will help to prevent you from getting overburdened when additional recurring costs come in.

|

| Hello world, I need some baby funds! |

Bonus: CDA bank accounts give a guaranteed, 2% interest for up to $36,000!

6) Cut down on unnecessary expenses

It's a good time to tidy up your house and arrange a space for baby stuff. Some unnecessary cost includes buying too many baby clothes, feeding sets, shoes and toys. These are things you will receive as gifts from family, friends and relatives and so, there is no hurry to buy them first.

Try to delay buying things that are not needed during your baby's first 3 months. Chances are you may forget that you ever bought them, or your baby may outgrow them in a blink of an eye.

Bonus: During my pregnancy, I wore my husband's t-shirts at home and they are definitely fitting and comfortable!

7) Re-evaluate your insurance coverage

Now that you are going to have a dependent, it is important to review you and your spouse's own insurance coverage and hospital plans. All Singaporeans and Permanent Residents have MediShield Life coverage, even for those with pre-existing conditions. Our Medisave account can be used to pay for MediShield Life premiums so you do not have to worry about the cash portion.

Bonus: You may also like to take a look at Integrated Shield Plans (IP) where I have compared the price difference for different companies.

8) Be prepared for other expenses

A confinement nanny is helpful to parents during the first month. Do reserve them as soon as possible as the popular ones are snapped up very quickly. Be aware that price is around $2,500 to $3,000, excluding cooking ingredients. If you are without a confinement nanny, you may intend to get confinement meals which cost around $60 a day for both lunch and dinner. For post-natal massage, 5 sessions cost around $300.

When your baby is older, you might need to look at the price comparison of different brands of formula milk and the prices for different brands of diapers. With these, hopefully you can make more informed decisions. Not to forget, planning for your baby's first month celebration can be a lavish affair. Buffets, decorations and door gifts all require upfront costs.

|

| They are worth every penny! |

Bonus: Ask for gifts in cash!

9) Evaluate infant care, nanny or grandparent options

If a grandparent is available to take care of your child, then you have one less headache. You may still need a maid or part-time helper to help with your house work. For caretakers, a nanny will charge around $750 to $850. If you are looking at infant care options, note that going to a government-run infant care centres ($600 - $700 for Singaporeans including subsidies) will be less expensive than going to privately-run centres (Usually at least $1,000) so do consider your options carefully. Don't forget to read up on the pros and cons of each option!

Bonus: You can claim the Grandparent Caregiver Relief if your parents are taking care of your children. There is also the Maid Levy Relief for foreign help and Additional Subsidy for infant and child care centres.

Conclusion

Financial planning is a big part of family planning. It may seem like there is a lot to do and I was initially quite worried if I could handle all these challenges.

Just take a deep breath and go through the list one by one. You do have enough time and these 9 months will prepare you in becoming a great parent. After which, get ready for all the crying, whining, milk stains and poop! I guarantee you all your efforts and sleepless nights will be worth it!

Final tip: If you want more grants, give birth to more babies! Just don't ask me when I am having my second child. :)

_________________________________________________________________________________________________

%2B(6).JPG)

Hi! Any idea if the pre-natal medical expenses can be claimed in the case if I am not delivering in Singapore hospitals? I am looking to deliver abroad but I am looking to do my first trimester scans here in Singapore. Am I eligible for the claims?

ReplyDeleteHi Jo,

DeleteI don't think it's possible. From MOH website,"To claim pre-delivery charges from Medisave, parents need to present the bills incurred for pre-delivery medical care to the hospital where baby was delivered. The hospital will submit these bills, together with the delivery expenses, for Medisave claims under the Medisave Maternity Package."

I may be wrong but you can find out the accurate information by calling them. Good luck!

I don't seem to get much info if I am able to claim for medisave if I am a pr?

ReplyDeleteHi Jia,

DeleteIf I am not wrong, for PR, you can use your Medisave to offset your delivery cost. However, the baby bonus grants will only be given if your child is a Singaporean! Hope this helps :)